Share:

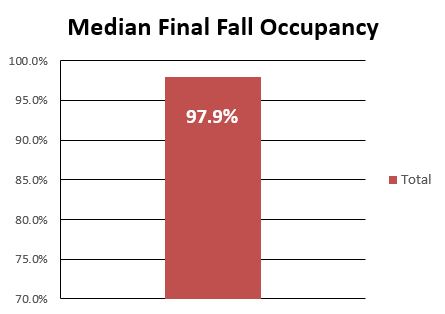

We thought it would be interesting to take a look at the final fall 2013 leasing results of the off-campus student apartment communities owned by the publicly traded student housing Real Estate Investment Trusts (REITS). Knowing the market conditions off-campus – specifically occupancy levels and rental rate increases — is beneficial for anyone involved with an on-campus housing program. Such data can be useful when analyzing the relative demand for your on-campus housing, including the potential to increase rental rates for the coming academic year. There is one important caveat: This information reflects only a sampling of each university market. However, given that REIT properties typically represent the newer and larger communities with close proximity to campus, we believe they are good overall indicators of the related university market. We obtained the data from the final fall 2013 leasing information provided in 3rd quarter financial reports published by: American Campus Communities, Education Realty Trust, and Campus Crest (links to this data provided at the end of this blog). The combined data for these three REITS totals 142,121 beds within 270 properties and 165 university markets. As reflected in the charts below, the average occupancy for these 270 properties was 94.11%, with the median at 97.9%. For the same properties, final rental rate increases (over the previous leasing year) averaged 1.07%, with the median reflecting an increase of 1.20%. (Click on charts to expand)

We also took a look at the “top 10” as well as the “bottom 10” properties with regards to occupancy and rental rate increases. The results are illustrated in the charts below. (Click on chart to expand)

We also took a look at the “top 10” as well as the “bottom 10” properties with regards to occupancy and rental rate increases. The results are illustrated in the charts below. (Click on chart to expand)

For these top 10 REIT properties with regards to occupancy, the average was 105.02% and the median, 102.60%. (Click on chart to expand)

For these bottom 10 REIT properties with regards to occupancy, the average was 57.97% and the median was 63.20%. (Click on chart to expand)

For these top 10 REIT properties with regards to rental rate increases, the average rate increase was 10.90% and the median 10.50%. (Click on chart to expand)

For these bottom 10 REIT properties with regards to rental rate increases, the average decrease in rates was -10.95% and the median -10.40%. (Click on chart to expand) For the detailed individual REIT property data, here are the company links: American Campus Communities: http://ir.americancampus.com/Cache/1001179610.PDF?Y=&O=PDF&D=&FID=1001179610&T=&IID=4092925 Education Realty Trust: http://www.snl.com/irweblinkx/yearlypresentations.aspx?iid=4095382 (Once at this site, click on the link entitled “Supplemental Package 3rd Quarter 2013”) Campus Crest: http://www.snl.com/irweblinkx/doc.aspx?iid=4258761&did=16169019 (Once at this site, click on the download PDF icon) I welcome your comments and questions on this data. Please contact me at airwin@capstoneoncampus.com